Bitcoin is no longer just something tech nerds talk about. It’s now on corporate balance sheets. It’s sitting next to cash and Treasury bonds. It’s part of treasury planning. Companies like Strategy (form. MicroStrategy) and Metaplanet are leading this move. The logic is simple: cash loses value over time. Bitcoin, on the other hand, has a fixed supply and long-term growth potential.

Let’s break down what this means for businesses, large and small.

What Does “Strategic Business Reserve” Mean?

A strategic reserve is something a business holds to preserve value. Traditionally, this would be dollars, gold, or government bonds. The goal is to park company money in a way that’s relatively safe and still maintains or grows value.

Bitcoin is now being used as one of these reserves.

Why?

Because fiat currencies tend to lose value over time. Inflation chips away at purchasing power. Central banks print money to respond to economic events. That money printing lowers the value of existing currency. Businesses holding a lot of cash start to lose.

Why Are Companies Like MicroStrategy and Metaplanet Doing It?

Michael Saylor, co-founder of MicroStrategy, made headlines by buying billions worth of Bitcoin. But what’s more interesting is how he did it.

He didn’t just use company funds; he also misappropriated them. He raised money by issuing stocks and convertible notes; borrowing capital from the market, then used those funds to buy Bitcoin. He called it a long-term strategy to protect the company’s value.

Strategy (formerly MicroStrategy) guides the corporate Bitcoin adoption movement with an astonishing 471,107 Bitcoin valued at approximately $47 billion.

The company funds these purchases through creative capital raising, which involves selling stock and issuing debt. They bought 10,107 Bitcoin for roughly $1.1 billion in just one week. Their shareholders approved an increase in authorized Class A shares to 10.3 billion to support future Bitcoin acquisitions.

In May 2024, they adopted Bitcoin as their strategic reserve. They did this during a time when the Japanese yen was weakening. At this point, holding Bitcoin made more sense than holding local currency.

Strategy’s approach is what I would term as both bold and controversial. Their 21/21 plan wants to raise $42 billion ($21 billion each in equity and debt) by 2027 to buy more Bitcoin. This strategy has sent their stock price soaring, up 704% in 12 months, but it also puts shareholders at risk of dilution.

When I first saw that plan, I felt both excitement and concern. Excitement, because it’s innovative. Got concerned because if BTC drops significantly, their equity financing may put them under serious pressure.

Japan’s Metaplanet, on the other hand, showcases Asia’s growing corporate adoption of Bitcoin, with holdings of 8,888 BTC. The company aims to acquire 210,000 Bitcoin by 2027, which would make it the world’s second-largest corporate holder of Bitcoin. Their stock has skyrocketed, up 1,744% since their first Bitcoin purchase in July 2024.

Metaplanet’s aggressive timeline stands out amid Japan’s unstable bond market. This shows how Bitcoin serves as a strategic reserve against local financial uncertainty.

The Mechanics: How Does a Company Buy Bitcoin?

This is important. It’s not just about transferring some cash from a business account and clicking “Buy.”

- Board Approval: The company’s board must agree that Bitcoin aligns with the treasury policy.

- Legal and Tax Review: Businesses assess how Bitcoin is treated legally and for tax purposes in their respective jurisdictions.

- Custody Solution: Bitcoin has to be stored securely. Some use cold wallets. Others partner with custodians like Coinbase Prime or BitGo.

- Accounting Impact: In most countries, Bitcoin is considered an intangible asset. If the price goes down, you record an impairment. If it goes up, you don’t record a gain unless you sell.

The beauty here lies in scalability, which allows for raising new money to fuel additional Bitcoin purchases. The danger, however, is leverage: if the Bitcoin price sinks, these instruments can add financial stress and shareholder dilution.

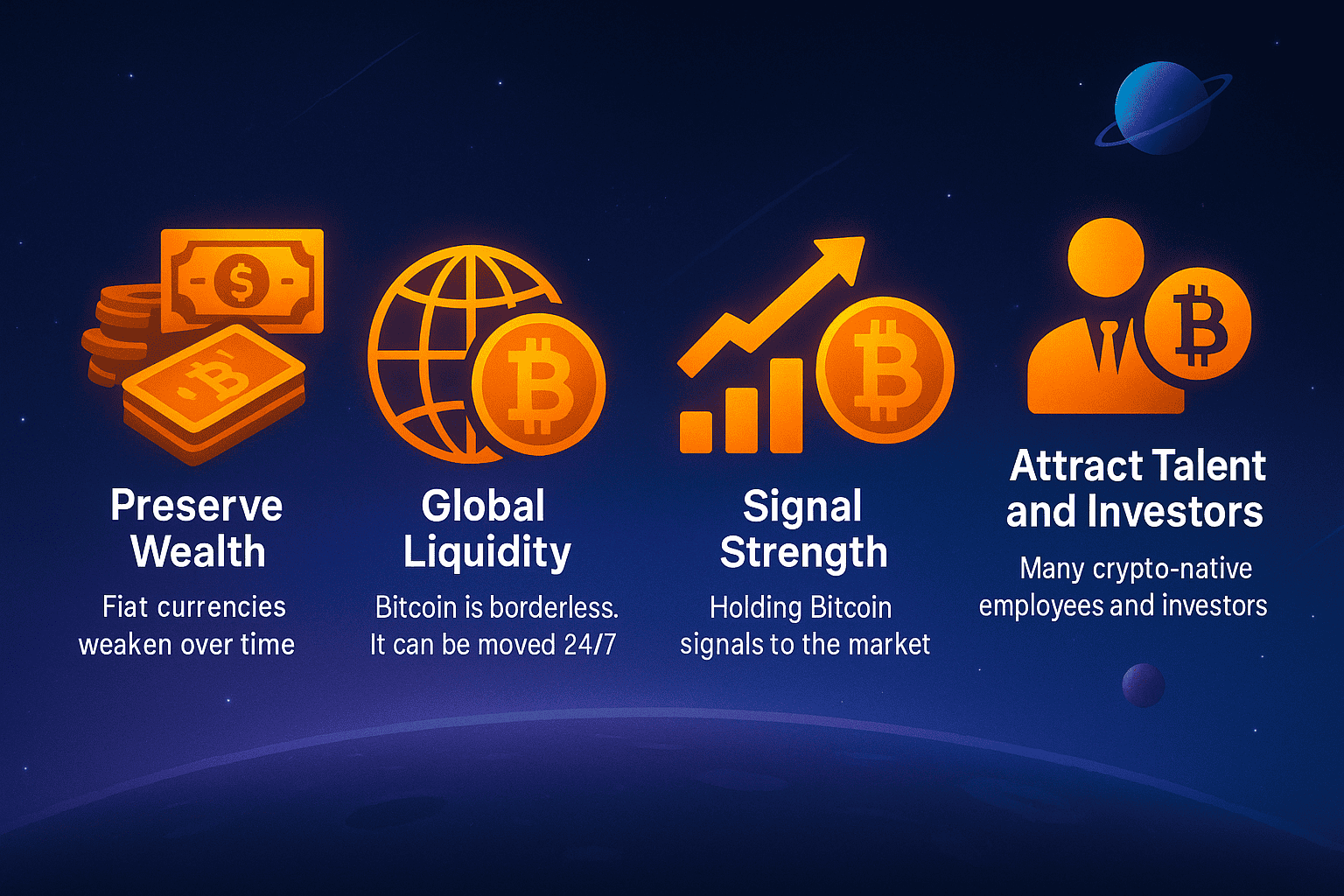

Why Would a Business Want to Do This?

Let’s go straight to the point:

- Preserve Wealth: Fiat currencies weaken over time. Bitcoin can serve as a hedge.

- Global Liquidity: Bitcoin is borderless. It can be moved 24/7. This flexibility is valuable.

- Signal Strength: Holding Bitcoin signals to the market that your company is forward-thinking.

- Attract Talent and Investors: Many crypto-native employees and investors look for companies aligned with Bitcoin or digital assets.

What Happens If Bitcoin Crashes?

Well, I think this might be dangerous if you don’t understand the risk. Bitcoin is volatile. It can drop 30% in a week. In a bear market, prices can fall for a year or more. If your business needs that money during the drop, you might be stuck.

Take MicroStrategy. At one point, they were down billions on paper. But they didn’t sell. They stuck to their long-term thesis. That’s because they started buying a while ago.

Some of the companies that are buying BTC right now, are buying it at a very high price. They are taking a massive risk, in my humble opinion.

If a company panics and sells during a bear market, they lock in losses.

So this strategy only works if:

- You’re not using this Bitcoin as working capital

- You can handle short-term volatility

- You’re committed to the long-term view

When doing this, I believe that companies should treat Bitcoin like long-term real estate. Don’t touch it unless you absolutely must.

Can Small Businesses Do This?

Yes. And more should.

When I first saw small businesses, such as cafes and digital agencies, start buying Bitcoin for their reserves, I was curious. It seemed risky. But after some digging, it made sense.

You don’t have to buy $1 million worth. Even $1,000 or $10,000 in Bitcoin can be a first step. It teaches you how custody works. It forces you to look into tax implications. It gets you in the game.

If you’re a small business:

- Start small

- Use a secure wallet or trusted custodian

- Track it separately from your core operating funds

Don’t go all-in. But don’t ignore it either.

And btw, I’m doing it as well.

Bitcoin as a business reserve is becoming the digital version of a Swiss vault. Small businesses can utilize it to store value, particularly in countries with unstable currencies or high inflation rates.

What Are the Main Risks?

Let’s not sugarcoat it.

- Volatility: Bitcoin is still a young asset. It’s driven by hype, news, and global events.

- Regulatory Changes: Governments can change tax rules or ban specific uses.

- Custody Issues: If you lose your keys, you lose your Bitcoin—no support line to call.

- Market Sentiment: Public perception can swing fast. If your business is publicly traded, holding Bitcoin may cause your stock price to fluctuate in tandem with it.

I think most of these risks are manageable. But they require homework. No business should touch Bitcoin without understanding self-custody, taxes, and liquidity planning.

What About Tax?

Bitcoin is taxed differently in each country.

In the U.S., it’s treated as property. You pay capital gains tax when you sell it. In Japan, Bitcoin holdings are subject to heavy taxation unless held as part of a corporate structure. In Sweden (where I live) t’s capital gains tax and regular income tax on it.

Businesses need a tax strategy. Work with professionals. Track every transaction. Use software like CoinTracking or Koinly.

If you’re not prepared for the tax side, the profits you make can easily be eaten up by penalties.

Why Are Businesses Doing This Now?

Simple timing.

- Bitcoin ETFs: have made institutional access easier.

- Inflation: has pushed businesses to look for better stores of value.

- Geopolitical instability: makes borderless, non-sovereign money more attractive.

- Public company precedents: have made it less controversial.

We’re now in a cycle where Bitcoin is being normalized as a treasury asset.

It’s no longer about being early. It’s about not being left behind.

So, What Next?

Bitcoin as a strategic reserve is still a new idea. But the momentum is growing. From billion-dollar companies to small online businesses, the logic is becoming harder to ignore.

- Fiat loses value.

- Bitcoin holds value long-term.

- Businesses need protection from inflation and currency risk.

When doing this, I believe that planning is everything. Don’t rush in. But don’t sit on the sidelines either.

What I think matters most is this: Bitcoin is optional now. In five years, it might not be. It could be as common as holding USD or gold.

Start learning. Start small. And stay informed.