Bitcoin’s 21 million coin limit showcases the sort of thing I love about this cryptocurrency. The system was built with an absolute cap; you can’t create more than 21 million bitcoins.

This built-in lack of unlimited supply serves a clear purpose. The Bitcoin network relies on approximately ten thousand machines, called nodes, spread across the globe to enforce this limit.

The numbers tell an interesting story. We expect to have mined approximately 19.9 million bitcoins by late 2024. Only 1.1 million bitcoins remain to be released.

This means that 90% of all bitcoins are already in circulation. The remaining 10% will trickle out in smaller amounts over the next hundred years.

Nobody will mine the final Bitcoin until around 2140. The deliberate scarcity of Bitcoin helps explain its value, which is similar to that of precious metals. With each coin now worth around $100,000, the cap’s impact on Bitcoin’s value becomes apparent.

Let’s examine why the 21 million limit exists, how the network enforces it, and what potential changes to this core feature might mean for Bitcoin’s future.

Why 21 million bitcoins?

The number 21 million captivates me because it wasn’t picked at random. Satoshi Nakamoto referred to this decision as an “educated guess” in emails that weren’t previously made public.

Bitcoin’s design aimed to create a currency that felt like existing ones but solved the problems associated with fiat money’s inflation.

This careful balance looked at both niche adoption and mainstream usage scenarios. Nakamoto could foresee that “if 0.001 is worth 1 Euro, then it might be easier to change where the decimal point is displayed”.

This prediction turned out to be modest – 0.001 BTC now equals approximately 47.62 Euro, almost 11 times higher.

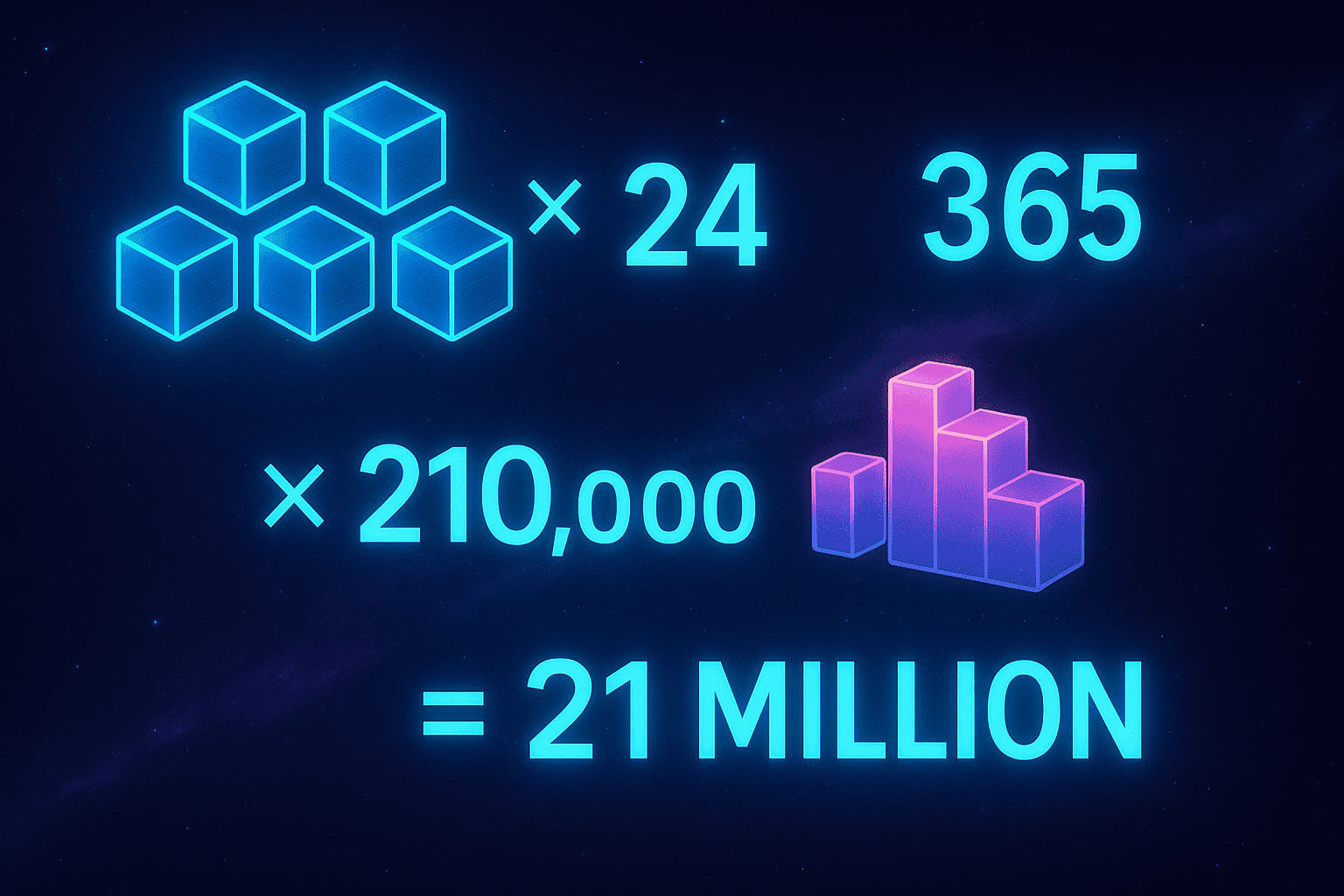

People often ask about the math behind this specific number. Bitcoin’s block reward system holds the answer. The math works like this: 6 blocks per hour × 24 hours × 365 days × 4 years = roughly 210,000 blocks per halving cycle.

The entire reward schedule (50 + 25 + 12.5 + 6.25 + 3.125 + …) totals 100 BTC. Multiply these numbers (210,000 × 100) and you get 21 million.

This cap brought something revolutionary – digital lack for the first time. Digital assets could always be copied endlessly before Bitcoin came along.

The technical side uses 64-bit integers with eight decimal places, which means one bitcoin equals 100,000,000 satoshis. This detail gives practical use at any price point.

The supply limit creates a deflationary economic model, unlike traditional currencies. Regular money allows governments to print unlimited amounts, but Bitcoin has a permanent limitation coded into its DNA.

This feature makes Bitcoin “digital gold,” possibly even rarer since the math can verify its exact supply.

How the 21 million cap is enforced

Bitcoin’s cap works through code that runs on thousands of computers worldwide. The sort of thing I love about this system is the technical mechanisms that make this limit work.

The “halving” event stands out as the quickest way to see this limit in action. It happens approximately every four years, or every 210,000 blocks to be exact. This programmed event halves the block rewards of miners.

The reward started at 50 BTC per block in 2009, dropped to 25 BTC in 2012, then to 12.5 BTC in 2016, 6.25 BTC in 2020, and reached 3.125 BTC in April 2024.

Bitcoin nodes follow strict consensus rules that power this enforcement. Each node checks new blocks to ensure they don’t create extra bitcoins. The network automatically rejects any block that tries to break this rule.

Additionally, it prevents inflation through transaction checks. Every non-coinbase transaction requires inputs that match or exceed its outputs, which prevents Bitcoin creation from occurring without a corresponding transaction.

This double-checking system is a vital component of Bitcoin’s supply cap that is often overlooked.

The math shows that these halvings will keep the total supply under 21 million. After the 2024 halving, we’ll see 29 more halvings until the final one-satoshi reward is reached. By 2140, approximately 99.9% of all bitcoins will have been mined.

What if the cap was changed?

Bitcoin’s 21 million cap could technically change, but such a change would have significant ripple effects. My experience with Bitcoin’s development has taught me about its mechanics and what they all mean.

The process would start with developers proposing a change through a Bitcoin Improvement Proposal (BIP). This would spark intense debates in the community and lead to a hard fork that splits the network. The chances of this happening are very slim.

A cap change would trigger several serious consequences:

- Trust would crumble – Bitcoin’s value stems from its limited supply. Breaking this would destroy trust, and the price would likely tank.

- Markets would panic – the price would crash, as Bitcoin’s value is tied to its limited supply.

- The network would split – a hard fork would create two versions of Bitcoin, causing chaos.

- Miners would face tough choices – They’d have to pick sides, even if more rewards looked tempting.

The “Blocksize War” of 2015-2017 illustrates how Bitcoin responds to significant changes in its protocol. The community maintained Bitcoin’s core design intact, even when 95% of miners wanted larger blocks.

Bitcoin Cash originated from this split, but now has a market capitalization of just $6.5 billion, while Bitcoin has reached a market capitalization of $2 trillion.

Miners might initially prefer more rewards, but they have good reasons to maintain the current system. They put $3.60 billion into equipment and spent nearly $9.00 billion on energy in 2024 alone. A price crash would wipe out these investments.

Will We Ever Beat The 21 Million Mark?

When I first heard people wondering why Bitcoin was capped at 21 million, I was curious too. However, after conducting thorough research, I now believe that question misses the point.

I believe changing that would cause more harm than good. The entire concept of Bitcoin relies on trust. The trust that no one can increase the supply. That trust disappears the moment the cap is broken.

So, will we ever beat the 21 million mark? I think it’s highly unlikely. And honestly, I don’t think we should. The limit gives Bitcoin its backbone.